GoMoon

What Is GoMoon?

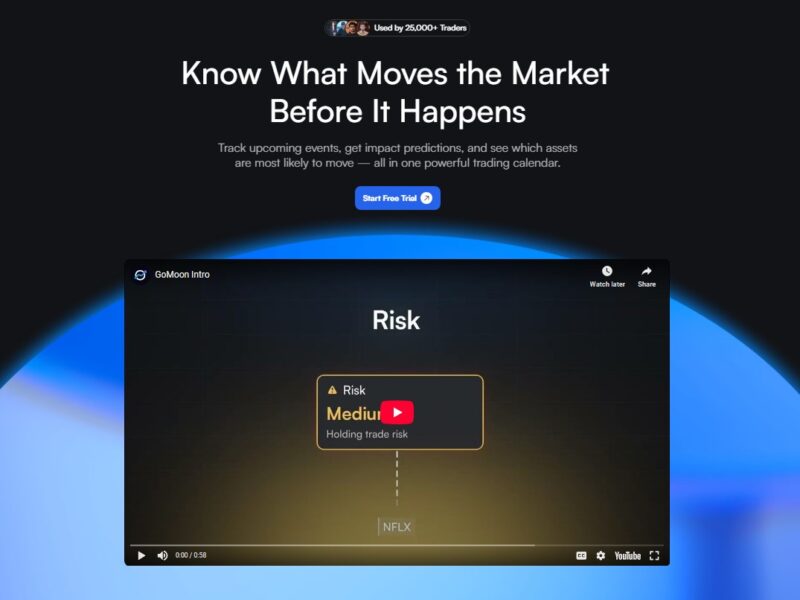

GoMoon is an AI-powered economic calendar and market insight platform designed specifically for traders and investors. Its purpose is to help users anticipate market-moving events, understand their potential impact on financial markets, and make better-informed trading decisions. Unlike a traditional economic calendar that simply lists dates and data releases, GoMoon adds AI-driven analysis, asset impact scoring, customizable alerts, and visual tools to turn raw macroeconomic information into actionable insights.

Features

GoMoon includes several advanced features tailored for traders and market analysts:

AI Event Impact Scoring

GoMoon’s AI assigns a score from 1 to 10 to each economic event, indicating its likely influence on market movements. This helps traders prioritize major events over routine releases.

Customizable Economic Calendar

Users can tailor the calendar to focus on events that matter most to their trading strategy by filtering by country, asset class, or event category.

Live Event Streaming

The platform streams key economic releases and monetary policy meetings directly in the dashboard, allowing traders to follow events in real time.

Historical Event Replay

Analyze past economic events and their market reactions with integrated advanced charts, helping traders learn from previous patterns.

Forecast vs. Actual Data Visualization

Compare forecasted data to actual outcomes with visual charts to spot surprises that often cause sharp price movements.

Custom Alerts and Notifications

Set personalized alerts for high-impact events or specific economic categories to stay informed without constant monitoring.

Pros & Cons

Pros:

-

AI-Enhanced Insights: Predictions and impact scoring help highlight the most relevant economic releases.

-

Customizable Interface: Tailored calendars and alerts make the tool adaptable to different trading styles.

-

Integrated Analytics: Live streaming and historical replay options add depth to event analysis.

-

Multi-Market Coverage: Tracks events across forex, equities, crypto, and commodities in one place.

-

Ease of Use: Designed with both beginner and advanced traders in mind.

Cons:

-

Subscription Required for Full Features: Advanced tools and alerts are behind a paid tier (e.g., Pro plan).

-

Predictive Models Are Not Fully Transparent: Like many AI systems, the exact methodology behind impact scores may not be fully disclosed.

-

Data Dependency: Quality of insights depends on the accuracy and timeliness of underlying economic data.

-

Not a Complete Trading System: GoMoon focuses on event analysis rather than direct trade execution or portfolio management.

Use Cases:

GoMoon serves a variety of trader and investor needs:

1. Day Trading and Intraday Strategies

Day traders can identify high-impact events before market openings or key sessions begin, helping them adjust positions or avoid volatility.

2. Swing and Position Trading

Swing traders and position investors can use historical event replay and impact scores to refine medium-term strategies.

3. Portfolio Risk Management

Alerts for critical economic data help investors mitigate risk by signaling when macro-shocks might affect holdings.

4. Multi-Asset Analysis

With coverage across forex, stocks, crypto, and commodities, GoMoon allows traders to understand cross-market reactions to the same economic triggers.

5. Educational and Strategy Backtesting

Historical event replay and visual comparisons help users learn how markets responded to similar conditions in the past.

Compared to Other Tools

GoMoon differs from standard economic calendars and trading tools in several ways:

-

Versus Basic Economic Calendars: Traditional calendars list data releases without context. GoMoon applies AI to rate impact and highlight which events could matter most.

-

Versus Trading Platforms: GoMoon focuses on event analysis and insights rather than order management, execution tools, or broker integration.

-

Versus Market News Services: Unlike general news feeds, GoMoon quantifies the potential market ramifications of economic events rather than simply reporting them.

-

Versus Algorithmic Trading Suites: Some algorithmic systems include economic data as one input among many, but GoMoon emphasizes clarity and event-driven decision support.

GoMoon is a specialized AI-driven economic calendar and event analysis platform designed to enhance market awareness and decision-making for traders and investors. By combining customizable calendars, AI-generated impact scores, live streams, and historical analysis tools, GoMoon offers a deeper understanding of how macroeconomic data influences asset prices. It is particularly useful for traders who base their strategies around economic releases, volatility, and cross-market movements.

While a subscription may be required for full access to advanced features and some predictive methodologies lack full transparency, GoMoon’s focus on actionable insights and event prioritization makes it a valuable addition to a trader’s toolkit — particularly for those seeking a data-driven edge over traditional event calendars.

FAQs

1. What markets does GoMoon track?

GoMoon analyzes economic events across major markets including forex, equities, commodities, and cryptocurrencies.

2. How accurate are the AI impact scores?

The impact scores are based on AI models trained on historical data and economic patterns; however, users should treat them as guidance, not guarantees.

3. Can I use GoMoon for free?

GoMoon offers a free tier with limited access, but advanced features typically require a paid subscription plan.

4. Does GoMoon provide trade execution?

No. GoMoon focuses on information and insights rather than executing trades or managing portfolios.

5. Can I get custom alerts for specific events?

Yes. Users can set custom notifications based on countries, event types, or impact levels.